we are

overview

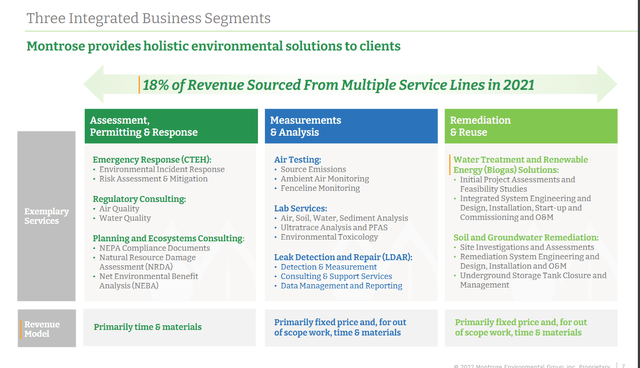

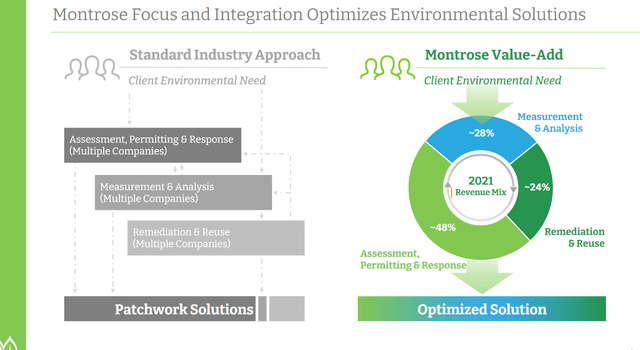

We recommend purchasing Montrose Environmental (NYSE: ME). The environmental industry is difficult to enter due to its complex regulations and fragmented market. As a result, customers are looking for an environmental solution provider that can address their entire environment. Across lifecycles and different jurisdictions. MEG aims to target an oversaturated market with many competitors, many of whom specialize in specific niches and regulations. MEG has the advantage of attracting and retaining clients and growing relationships with its global reach and diversified services. When competing for large accounts that require a nationwide provider, MEG has the ability to provide geographically dispersed unified services and a single point of contact for all client needs. stands out in

Company Profile

Environmental and air quality tests are Provided by MEG. The company’s customers include waste management centers, power plants, water treatment plants, municipalities and multinational corporations around the world.

Investor ppt in November 2022

The environmental industry is a difficult problem

The environmental sector is large, sprawling, fragmented and subject to complex regulations. Demand for environmental services is driven by the need for regulatory compliance at all levels.

As stated in the MEG S-1, its target market is saturated with thousands of competitors. Many large companies provide limited environmental services as an afterthought to their main business. However, the majority of companies serving this sector are small and either specialize in serving a narrow set of markets or complying with a narrow set of regulations. Given the technical knowledge, certifications, and licenses required to serve a wide variety of clients and industries across geographies and service lines, we believe there are structural barriers to expansion for small businesses. These factors make entry into the MEG industry very difficult.

Customers are looking for efficient and personalized ways to reduce their environmental impact, and we believe they place a high value on large-scale environmental solution providers. Especially for companies and organizations in multiple jurisdictions subject to complex regulatory frameworks, a provider (such as MEG) that can address the full lifecycle of environmental issues and requirements will remain competitive.

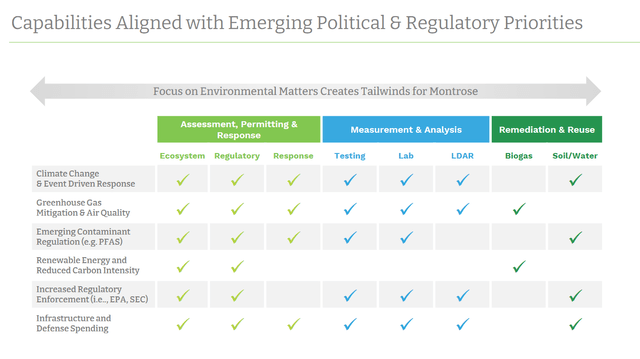

That aside, the need and demand for environmental services is growing as a result of increased public awareness and stakeholder demands for environmental sustainability. Thanks to the widespread adoption of CSR and ESG programs, a company’s environmental impact has become an essential consideration. These efforts are aimed at proactively managing emerging threats, rather than focusing solely on ensuring compliance, as has been done in the past.

The demand for environmental services is also driven by many other factors, such as sustained growth in industrial activity, investment in infrastructure and accompanying regulations. A further increase in demand is the disruption of the natural environment caused by climate change and the deterioration of infrastructure.

Investor ppt in November 2022

MEG, a one-stop shop for global expansion

With the addition of new products, MEG is now better able to meet all customer demands for environmental services. For example, MEG can conduct environmental assessments, obtain necessary permits, and conduct necessary tests in preparation for remediation projects. Some remediation providers, such as engineering service providers, may not have in-house testing capabilities and instead contract with external vendors.

Investor ppt in November 2022

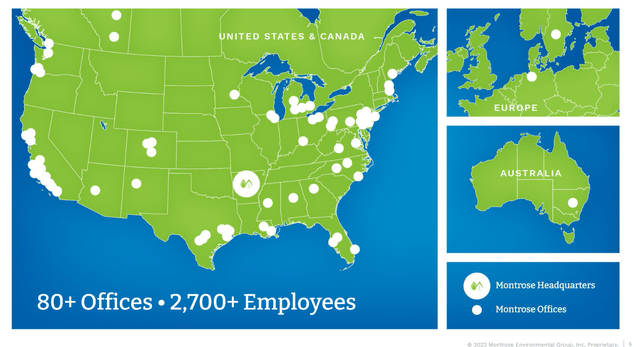

Additionally, MEG has a global reach. We believe that customers appreciate MEG’s ability to provide a geographically distributed and unified service. MEG’s strategic mergers and hires have given the company the scale it needs to compete globally and complete projects. The company’s international reach has helped MEG reach new customers and meet the needs of existing customers. In my opinion, MEG’s range and comprehensive portfolio of products will attract new customers and retain existing ones at a time when more and more customers are looking for an environmental solution provider who can handle their problems throughout their lifecycle. , believes it is well positioned to expand existing relationships. and in multiple jurisdictions.

Investor ppt in November 2022

Overall, I think being able to provide a single point of contact for all of a client’s needs is a major selling point when competing with larger accounts that require a nationwide provider. From a perspective, it’s easier to deal with a single vendor than a collection of point solutions that may or may not be compatible with each other. The difference becomes even more apparent when we are talking about multi-million dollar projects that take years to complete.

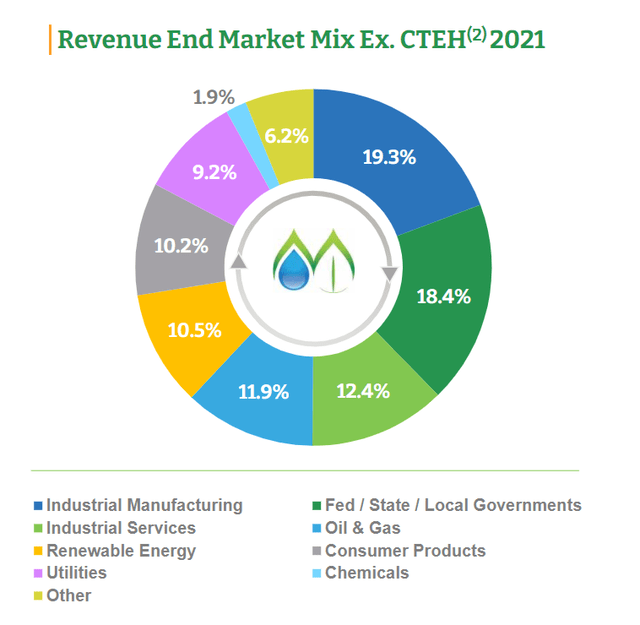

A long-term and diverse customer base reduces business risk

MEG has worked with many of the Fortune 1000 companies and government agencies over the years, which now serve over 5,300 clients. In addition to its large customer base, MEG’s revenues are spread across numerous projects and geographies. Moreover, the number of projects MEG completes for these clients every year ranges from one to dozens. Moreover, MEG’s financial success does not depend on a single client’s spending. MEG also serves numerous industries and organizations. As a result, MEG’s business is less dependent on a particular industry, which I believe makes it more resilient to recession.

Investor ppt in November 2022

Attractive business model

I think the fact that MEG’s earnings are relatively immune to political change is one of the company’s biggest selling points. One reason is that it does not rely on a specific set of regulations to operate. MEG also operates in various geographies, helping clients meet the requirements of various regulations. MEG is therefore generally protected against significant changes in legislation. The federal government has some basic requirements, but many state, state, and local laws are more stringent. Not surprisingly, state, state, and local governments frequently outline procedures to be followed to achieve or enforce environmental standards. Policy changes are less likely and less impactful when different departments of government work together.

In my opinion, MEG’s ability to weather the economic storm is underpinned by the breadth and depth of services it offers and the variety of industries it serves. It is important to remember that different industries may experience peaks in customer activity at different times, regardless of the economic cycle. In addition, many of MEG’s offerings are generally discretionary, and projects frequently generate significant value customers, further encouraging continued use of MEG’s services.

Growth opportunities through M&A

MEG’s growth has been phenomenal thanks to its policy of aggressive expansion through acquisitions. Since its inception, the company has acquired over 50 companies. To expand its service offerings and geographic presence, MEG typically seeks acquisition targets with strong management teams capable of introducing innovative new technologies and processes. As MEG competes in a wide variety of niche markets, we expect the company to maintain an acquisition-like nature.

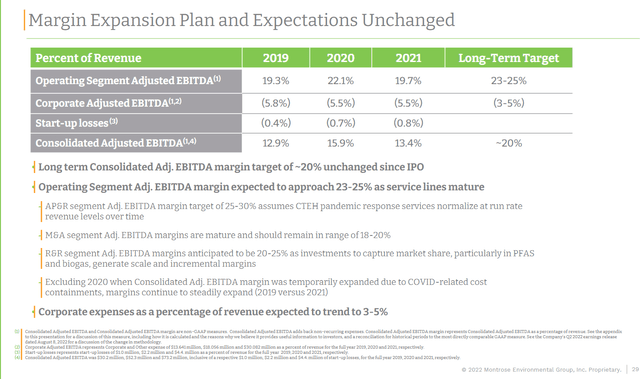

Q3 2022 results in line with plan

MEG reported financial results for the third quarter of 2022, which were in line with expectations. Importantly, MEG’s services for treating PFAS-contaminated water, generating renewable energy, and measuring greenhouse gases were all still in high demand. Additionally, MEG has not changed its FY22 earnings guidance, which remains $535 million to $555 million, and his adjusted EBITDA margin is $68 million to $73 million. We are also relieved that the company’s comments indicate that it has been successful in raising prices and that it expects continuous improvements in quarterly profit margins to continue through the fourth quarter of 2022.

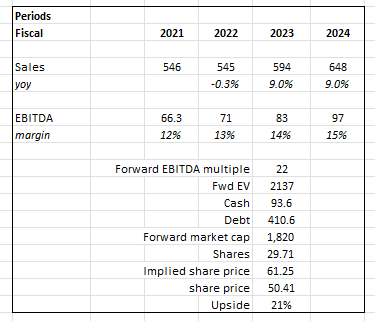

evaluation

I think MEG has a 21% uptick. MEG expects earnings to continue to grow in line with historical underlying earnings growth in the high single digits, driven by ongoing long-term trends. MEG also needs to continue to incrementally increase its profit margins each year to further optimize its cost base and meet management’s long-term target (20%).

Unfortunately, we missed the first wave of gains due to a valuation reassessment. MEG is currently trading at 22x its historical average forward EBITDA, and we expect this to remain unchanged.

own calculations

Investor ppt in November 2022

risk

M&A risk

MEG’s growth is primarily due to acquisitions, and we expect this trend to continue. If MEG does not complete many deals, MEG’s future growth rate may be lower than its historical trend. Also, if MEG fails to successfully integrate acquired companies, it is possible that revenue and cost synergies will be less than expected. A high rate of mergers and acquisitions can also make it difficult for companies to establish a consistent culture.

Difficult for investors to evaluate MEG

To succeed in the markets Montrose serves, it must compete with large companies offering similar services, but also provide a more comprehensive solution than its smaller regional rivals. . Without a direct public competitor, investors may find it more difficult to assess his MEG’s performance relative to the market.

Conclusion

Complex regulations and fragmented markets make it difficult to enter the environmental industry. As a result, companies are looking for environmental service providers who can address issues across a wide range of sectors and geographies. With a global presence and extensive service catalog, MEG is better positioned to win new business, satisfy existing customers and nurture existing partnerships.